Japan Real Time Charts and Data

Friday, December 28, 2012

A retrospective look at Japan's banking crisis

The thesis of this analysis is that Japanese monetary/fiscal authorities handled their post bubble banking crisis relatively well compared to how the US has handled its banking crisis which began in 2008. The paper contains a lot of good data so it is worth the time even if you disagree with Koo's conclusions.

However, it looks like Koo is defining "success" as a fourteen year recessionary period.

The problem I have with this Koo analysis is with its conclusion is that Japanese monetary/fiscal authorities did mostly the right things. The paper shows that the Japanese equivalent of the FDIC's Deposit Insurance Fund was in a negative balance from 1996 to 2008. This implies that it could still be in a negative balance now. If your deposit insurance fund is negative, that's not "success".

In Japan much of the banks' bad loans were simply shifted into government debt.

Koo posits the concept that the US is handling its banking crisis differently when in fact the US is doing the same things that Japan has done.

Wednesday, December 26, 2012

Japan breaking new ground in monetary policy

He states that

"something much more significant is afoot - the possibility of explicit cooperation, albeit perhaps forced cooperation, between fiscal and monetary authorities. The loss of the Bank of Japan's independence to force the direct monetization of deficit spending is the real story."

and that the result of this is that

"Japan might very well be heading toward the end-game of permanent zero interest rate policy: Explicit monetizing of deficit spending. That is the real story here - it goes far beyond just inflation targeting."

The result of this monetization would be government created demand for products and services. Of course, to be beneficial in the long run, such government spending should be directed toward technological progress instead of simply funneling money to vested interests.

Monday, November 05, 2012

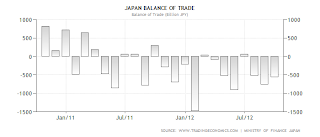

Japan consistently running trade deficits

Since practically all of the country's nuclear power generating capacity has been shut down, the country has been reliant on oil and natural gas imports, which contribute to the negative trade balance.

Given this situation, Japan is likely no longer a net purchaser of US Treasury debt.

Tuesday, June 12, 2012

IMF warns Japan regarding fiscal policy

"The International Monetary Fund urged the Japanese government on Tuesday to raise the country's sales tax and reform its welfare system to demonstrate a commitment to fiscal reform."

Japan's parliament is considering a plan to double sales tax rates by 2015. Similar proposals over the years since the end of the country's boom in the early 1990's have generally been rejected as being likely to harm domestic consumption. The same issue is still relevant, but the need for more tax revenue is more pressing now.

This fiscal action would be deflationary, at a time when the country is arguably already experiencing deflation.

Friday, May 25, 2012

Reading The Writing On The Japanese Wall

Yet something somewhere fails to convince me that this nonchalance is really justified . Something tells me that this process of rising debt and falling credit ratings cannot go on and on forever, and that at some point we will reach what Variant Perception's Claus Vistesen calls "the end of the road". In which case, we could start to ask ourselves, what then gets to happen next? Certainly there is nothing in conventional economic theory which can help us anticipate the answer, since this kind of end of the road point has not been forseen, anywhere, unless I am mistaken.

On one view, Japan seems to have invented what seems to be some kind of economic perpetual motion machine. Since the country has an external surplus, and can print its own money, there is a savings surplus, and no problem selling government debt, even at ridiculously low interest rates. And since the interest paid remains ridiculously low, then there is no problem servicing the debt, and if there ever was, why then the Bank of Japan could just buy even more of its own government bonds, effectively driving the interest rate even lower. In theory there is no good reason why it couldn't even follow the lead being currently set in Germany, and push the rate into negative territory. Heck, the government would then be even earning income on its debt.

But somehow or other this view fails to convince, in particular it fails to get to grips with why Japan has gotten into this ridiculous situation. It also doesn't offer any kind of road-map for how the country could ever get back to the sort of monetary regime that was once widely considered to be "normal". Or are we all destined to slowly drift towards the financial equivalent of the world that was so ably described in Scott Ridely's cult film Blade Runner?

But if there is no longer hope of exit, and we are now evolving towards what could be considered a brave new financial world, we could we at least spare the time to ask ourselves why this is happening. Certainly from a macroeconomic point of view the explanation "that's just how it is" feels far from satisfactory, while the argument that we just need to continue long enough and hard enough along the current path before the Japanese economy somehow "rights itself" - after more than two decades - appears to be based more on belief and hope than any thorough empirical analysis of the situation. As I keep repeating, we are entering terrain which was never really contemplated by neoclassical theory, in either its Keynesian or its Austrian variants.

Despite the frequent references to "Japan's lost decade", the country has now lost not one, but two - what was it Oscar Wilde said, losing one child could be an accident, but losing two has to constitute negligence - and we seem to be all set to have a third one in front of us, as long markets and weather permitting, always assuming the Japanese government remains able to finance its debt.

The Deflation Issue

The argument that Japan's economic and financial system is simply undergoing a much needed correction after the unwinding of the excesses of a stock market boom (1989) and property bust (1992) as we enter the third decade of the problem doesn't, as far as I am concerned, seem credible. The heart of the problem has been the deflation issue. The Japanese economy first fell into some kind of deflation trap in the mid 1990s. Following a sharp reduction in interest rates and a massive injection of capital into the banking system in 1997 inflation briefly recovered, only to fall back into negative territory again at the turn of the century. The problem has persisted ever since, with the exception of a brief spell of inflation during the oil price surge in 2008 (see CPI chart below). However, even this timid inflation disappears if we look at the core (ex energy, ex fresh food) index, which never really left negative territory, and which was still registering a minus 0.5% annual rate in March (the latest month for which we have data).

At the heart of the deflation problem in Japan has been the ongoing slump in land prices, which are now still stuck around early 1980s levels (watch out Spain). Land prices did briefly rise for the first time in 16 years in 2007 as a wave of speculative activity saw external investors flocking in to what they were promised would be a new boom (shades of Germany 2012), but then slumped back again in the "risk off" environment which accompanied the onset of the Global Financial Crisis. Prices have continued to fall, and if the metric of golf club membership fees used by Bloomberg reporters is anything to go by, 2012 looks set to be another bad year.

The result of all this deflation is that nominal GDP has fallen substantially in Japan since the 1997 high. In real terms, Japans GDP grew just just 25 percent between 1990 and 2007 while the contraction experienced during the recent crisis has sent 2011 real GDP back to its 2005 level (while nominal GDP slumped to 1991 levels).

Naturally, it is this fall in nominal GDP values which lies behind the massive surge in the government debt to GDP ratio, although as the IMF point out, the constant budget deficits and ongoing low growth have played their part.

The steady increase in primary deficits, from an average 1.7 percent of GDP in the 1990s to an average 5 percent of GDP in 2000–07, is reflected in the evolution of the net debt ratio, which rose from 12 percent of GDP in 1991 to 81 percent in 2007 (67 to 188 percent in gross terms). Following the global financial crisis, net debt escalated sharply, to 117 percent in 2010. - IMF report to the G20 "Japan Sustainability".

This means that over the years the Japanese built up a strong net external investment position which leaves the current account strongly positive despite the negative goods trade balance due to the high income flow from investments abroad. This is very different from Italy and Portugal, countries which have long run both trade and current account deficits and have very poor net external investment positions.

The real issue is for how long Japan can maintain its current account surplus, given its declining household saving rate, and the need of its growing elderly population to draw down savings.

Savings Imbalances

As the IMF points out, Japan's high aggregate private saving rate masks a deep imbalance between sectors. "In particular, the aggregate rate reflects a high corporate saving rate, which trended up from 13 percent of GDP in 1981 to 21 percent in 2009, and a very low household saving rate, which declined from 10 percent of GDP to less than 3 percent over this period".

The falling household saving rate is undoubtedly demographically linked (as populations age they tend to draw down on savings), although the downward pressure on wage income resulting from globalization also plays a part. The key issue is though, for how long will corporate saving, and the resulting income flow, keep the country's debt afloat.

As the IMF puts it:

"Should JGB yields rise from current levels, Japanese debt could quickly become unsustainable. Recent events in other advanced economies have underscored how quickly market sentiment toward sovereigns with unsustainable fiscal imbalances can shift. In Japan, two scenarios are possible. In one, private demand would pick up, which would lead the BOJ to increase policy rates, in which case the interest rate growth differential may not change much. The other is more worrisome. Market concerns about fiscal sustainability could result in a sudden spike in the risk premium on JGBs, without a contemporaneous increase in private demand. An increase in yields could be triggered by delayed fiscal reforms; a decline in private savings (e.g., if corporate profits decline); a protracted slump in growth (e.g., related to the March earthquake); or unexpected shifts in the portfolio preferences of Japanese investors. Once confidence in sustainability erodes, authorities could face an adverse feedback loop between rising yields, falling market confidence, a more vulnerable financial system, diminishing fiscal policy space and a contracting real economy".

"Japan will run out of savings to buy JGBs by 2016, but the market will respond sooner. Ifthe Japanese government continues to issue debt, the Japanese economy is going to run out of savings to buy the new debt. The share of government debt to total currency and deposits will soon reach close to 100%. At this point of the endgame, there is no way out for Japan: either the central bank or foreigners must take up the bid, or Japan must begin to sell off foreign assets. Markets will price in the endgame before it happens".

Demographic Drift

Japan's population - in median age terms - is the oldest on the planet. Median age is around 45, and it continues to rise. There is no real prospect of it coming back down again, since the process appears to be totally irreversible.

A large chunk of the debt problem is demographically related (see chart below). Since the early 2000s, Japan’s non-social security spending has been well contained and, at about 16 percent of GDP in 2010, was the lowest among G-20 advanced economies. Meanwhile, social security benefits have risen steadily due to population aging. Social security spending rose 60 percent in 1990–2010, accounting for about half of consolidated government expenditures in 2010. Moreover, a sustained increase in the old-age dependency ratio has implied larger social

security payments supported by a shrinking pool of workers, which has rapidly deteriorated the social security balance.

Unorthodox Policies

In an article published in the late 1990s and entitled "Japan: What Went Wrong?", Paul Krugman starts to wrestle with a problem which had evidently been bugging him for some time, as the title of the piece shows. The whole text is worth reading, as it gives important background over how the modern debate about what to do with countries who fall into a liquidity trap came into existence. In many ways it was Krugman himself who brought it back kicking and screaming into the current discourse. In fact, he asked himself a question which many others could have asked, but few have chose so to do.

"How could a wealthy, productive, sophisticated country have gone from enviable growth in the 1980s to stagnation in the '90s, and now be slipping into a downward spiral of recession and deflation?"In order to do this he looked at a number of the explanations that had been offered for the particular nature of the Japanese "malaise":

Explanation 1 is that it is mainly a financial problem. Japan's corporations are too burdened with debt, its banks too burdened with bad loans that have never been acknowledged. On this view, what Japan needs is a long, painful financial housecleaning.Well, of course, both of these explanations are immediately contextualiseable in the context of housing boom/bust societies like Spain or Ireland. The financial system got broken and credit dried up, at the same time consumers got frightened by continually falling property prices and started to keep their wallets wide shut. But leaving aside the issue of whether a "jump start" which was large enough and sustained enough would be big sufficient to return Ireland and Spain to a regular growth path, there was obviously something "funny" going on in Japan, which is why Krugman started to consider an Explanation 3.

Explanation 2 is that the problem is mainly psychological. When the "bubble economy" of the 1980s (remember when the square mile under the Imperial Palace was supposedly worth more than all California?) burst, goes the story, consumers and investors went into a funk that has depressed the economy, and the depressed economy has perpetuated the funk.

Until recently I was more sympathetic to Explanation 2. But lately I have started to wonder whether the stubborn unwillingness of Japan's economic engine to catch is, as many foreigners seem to think, merely because the jump-start hasn't been big enough or sustained enough. And so (like a small but growing number of people, including at least one influential Japanese economist and I have started paying attention to Explanation 3--that Japan's troubles really stem from a subtle but deadly interaction between demography and ideology.Well, all this sounds familiar, doesn't it? It sounds vaguely related to things you will find scattered across my blog posts, and in fact this is not surprising, since it was reading this piece, and another one entitled "It's Baaack! Japan's Slump And The Return Of The Liquidity Trap" (see the appendix to my 2008 post "Did (or Didn't) Japan Just Re-introduce Quantitative Easing?" for the relevant excerpt), that really started me thinking that what was going on in Japan might have some sort of demographic connection.

Here's the story: Japan, like the United States only much more so, is an aging society. Thanks to a declining birth rate and negligible immigration, it faces a steady decline in its working-age population for at least the next several decades while retirees increase. Given this prospect, the countryshould save heavily to make provision for the future--and lacking the kind of pay-as-you-go Social Security system that allows Americans to ignore such realities, it does. But investment opportunities in Japan are limited, so that businesses will not invest all those savings even at a zero interest rate. And as anyone who has read John Maynard Keynes can tell you, when desired savings consistently exceed willing investment, the result is a permanent recession.

But, as I argued in e-mail communication with Krugman at the time, if Japan is going to see a decline in working population over the next several decades (and possibly much longer, since so long as fertility remains below replacement rate each generation will be smaller than the previous one) and if this lies at the heart of the problem, then it means the problem is a deep structural one which won't be resolved by any kind of "kick start", however large. It isn't a question of a planet which has slipped off its orbit, and just needs a nudge to get it back on, it is a planet which has veered off onto a whole new trajectory, which leads who knows where. As I say, this situation was never contemplated by the founders of neoclassical theory, and yet, having started in Japan, the phenomenon is now extending itself steadily across all developed economies in one measure or another. Curiously, while you will find these kind of reflections spread out all through my work, it has been many years since I have seen Krugman come back to the issue.

I think that Krugman's work at the time was truly innovative. He identified a problem, a country with an ageing and declining workforce, and he looked for a solution to that problem. This put him head and shoulders above the majority of his contempories. But he stopped short of digging deeper, and allowed his spade to be turned too soon. He could see that the problem was one of demand deficiency due to the changing balance between saving and borrowing, but he didn't follow this through and see that the problem was not simply temporary (even if decades long) but more or less permanent, and he didn't see that this demand deficiency results in export dependency (leveraging the global rather than the local economy in the search for customers), and that the only consequence of having permanent fiscal injections would be not to give stimulus, but rather an accumulation of debt that will be increasingly harder for those smaller and poorer (deflation) workforces to pay down in the future.

In similar fashion, those who urge a solution to Europe's imbalances via an increase in German fiscal deficits to stimulate consumption miss the point: arguably what people in these societies need to do is save more, not less, and certainly when it comes to the public sector. Which brings us back to Fitch Ratings and the Japanese downgrade. The core issue of the moment is the attempt by Japanese Prime Minister Yoshihiko Noda to raise the country's consumption tax from 5% to 10%. As Paul Krugman would tell you, such a move would bring in revenue, but would weaken internal demand even further. Effectively it amounts to austerity in a country which is "growth challenged" and just as in Portugal and Italy, austerity is not popular with voters. In a recent poll only 40% of those questioned were in favour of the measure, while 50% were opposed. As a result, and attempt to push through the increase could split the governing Democratic Party and bring down the government.

Meantime Former Japanese Finance Minister Hirohisa Fujii has warned that failure to pass the legislation will inevitably spark ratings agencies to implement further downgrades and yet more downgrades of the kind which might eventually force banks to sell off their government bond holdings, making one of the IMFs nightmare scenarios come true. However, as Bloomberg's Isabel Reynolds points out:

Fujii’s warning is at odds with previous credit rating downgrades that have failed to result in higher interest rates. Japanese banks face a total of 6.4 trillion yen ($80.4 billion) in valuation losses on their holdings of government bonds if interest rates increased one percentage point, the Bank of Japan (8301) said in a report last month. Domestic deposit-taking institutions hold about 39 percent of JGBs, while about 8.5 percent are held by foreigners. Japanese government bond prices have so far been unaffected by the country’s ballooning debt. The country’s credit rating has been downgraded by Standard and Poor’s four times since 2001, and over that period yields have fallen more than 52 basis points.Unfortunately, just because it hasn't happened yet doesn't mean it never will, as we saw with house prices that only went up. If the downgrades pile on fast enough, and junk bond status approaches, expect markets and banks to react. As Claus Vistesen says, they have four or five more years, and the clock is ticking away.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Friday, March 23, 2012

Re-thinking trade policy in an era of expensive energy

"Japan’s gas-fired power plants are boosting output to compensate for nuclear reactors shuttered since last year’s earthquake, driving Asia-bound cargoes to a record. The U.S. has surplus natural gas extracted from shale rocks deep underground, and while it lacks a facility to liquefy that fuel for shipping, cargoes delivered to the country under longstanding contracts can be re-exported when overseas prices are higher.

“There’s a huge arbitrage,” Arctic analyst Erik Nikolai Stavseth said by phone yesterday. “When someone is willing to pay that much to move gas from A to B, it tells you demand is very strong.”"

Specifically, "One million British thermal units of LNG costs $17 in Japan and $2.62 on the U.S. Gulf Coast ."

At differentials that great, it's not inconceivable that the US could develop a trade surplus with Japan.

Monday, March 05, 2012

Japan's economic problems in summary

-The total shutdown of all 54 nuclear plants, leading to an energy insufficiency

-Japan's trade deficit in negative territory for the

first time in decades, driven largely by energy imports

-A budget deficit that is now 56% larger than revenues (!!)

-Total debt standing at a whopping 235% of GDP

-A recession shrinking Japan's economy at an annual rate of 2.3%

-Renewed efforts underway to debase the yen

Efforts to weaken the currency are unlikely to be successful because in particular the USA is pursuing the same strategy.

Martenson supports the thesis made previously here:

"It is a very big deal that Japan is slipping into negative trade territory for the first time in three decades. Last spring I was writing about how the global flow of funds -- the massive tide of liquidity sloshing back and forth -- involved Japan to a large degree. Japan was the hub of a massive carry trade, was buying huge amounts of US Treasurys and, in general, was a vast emitter of liquidity flows to the world.

With its reconstruction costs and now with its trade deficit, Japan becomes a net consumer of funds. In other words, the flow of funds reverses. This represents, at the very least, a change to the global liquidity tide charts."

Wednesday, January 25, 2012

Japanese annual trade deficit reflects industrial strategy reversal

Reuters reports today that Japan's first trade deficit since 1980 raises debt doubts:

"Japan runs trade deficit of $32 bln in 2011

Dec exports -8.0 pct yr/yr, imports +8.1 pct"

A key is the problem of increased reliance on fuel imports due to the loss of nuclear power. Only four of the country's 54 nuclear power reactors are operating.

To make up the energy gap, Japan increased fossil fuel imports 25.2%, almost one third of Japan's total overseas spending. Imports of oil, gas and coal all increased. Alternatives to fossil fuel will take years, if not decades to implement. These facts suggest that Japanese demand will add significant support to global hydrocarbon prices.

Another issue is offshoring; Businessweek reports that:

"Manufacturers from Panasonic and Honda to Sony Corp. and Toyota Motor Corp., which helped fuel three decades of trade surpluses, are moving output overseas as the yen trades near a postwar high, making exports less profitable."

A declining population also provides incentive for offshoring simply to find workers to staff manufacturing operations. Moving the work offshore also avoids cultural complications from the possible alternative strategy of allowing foreign workers to immigrate.