The quote from Moody's is

"Japan's credit profile is Aa2

The unified rating of Aa2 reflects Japan's considerable strengths. These include Japan's large domestic savings, a strong home bias on the part of its domestic financial institutions and institutional investors, relatively low holdings of government debt by foreign investors, and Japan's $1 trillion of official foreign exchange holdings. Moody's believes the domestic market will absorb the record level of bond issuance this year to fund the government's economic stimulus program. However, the rating also reflects the risks of Japan's high level of debt, which leaves the country's fiscal position vulnerable to shocks or imbalances that would cause a sharp rise in interest rates. The ratings also reflect the sizable but temporary increase in the government's budget deficit caused by the severe effects of the global collapse in trade and recession on the Japan's economy. Further, Japan's large foreign exchange reserves, although large compared to those of most other countries, are only a small fraction of its liabilities and could not alone eliminate refinancing risk at a time of severe stress."

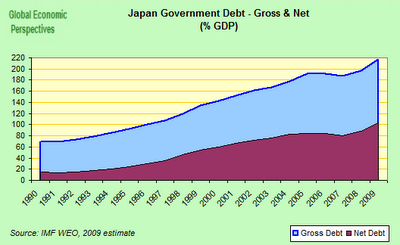

Here is a look at the trend in Japan's government debt(courtesy of Edward Hugh):

That net debt number is likely to exceed 100% of GDP in 2009. Moody's noted that very little of this debt is held by non-Japanese. Of course, one of the primary causes of this is the fact that much of this debt was issued at extremely low interest rates. So it was relatively unattractive to foreign investors. Japan's government debt amounts to the country's citizens avoiding taxation now with the expectation that the country's future productivity will be great enough support repayment of the debt in the future without ruinous taxation levels.

The Bank of Japan holds over $600 billion in US Treasury debt. In theory, the proceeds from these holdings as they mature could be used to reduce the outstanding domestic debt over time. Of course, that would put upward pressure on the yen versus the dollar and thereby weaken the country's export sector. The decision that faces Japan's leadership today is whether to continue to depend on exports, or shift policy to supporting the domestic sector more and thereby increasing the proportion of GDP generated domestically. Such a shift would result in short term difficulties, but in the long run would serve the Japanese public best.

Other weaknesses of Japan include the fact that it has no meaningful defense forces, and its agricultural sector cannot produce enough to feed the country's population for any meaningful length of time. Also, Japan relies on imported fuels for over 80% of it's energy needs.

Another issue is that somehow the fact that Japan has been running inflationary policies for 18 years now is easy to miss when their nominal numbers all are so flat. It was easy to see the inflation get exported to the US and the rest of the world through the carry trade mechanism. The question that doesn't seem to be asked is where all of those yen went after the carry trades were unwound. At some point the BoJ has to remove the excess yen, which would obviously be deflationary, or we should expect a collapse in the yen.

(A cross post by Scott Peterson from Wasatch Economics)