Firstly he argues most cogently that Japan has not in any meaningful way "decoupled" from the US.

"Despite talk that Japan has “decoupled” from the US economy, the opposite is the case. The turbulence in Japan’s financial markets unleashed by the US credit crisis is just one sign. More fundamentally, Japan’s current recovery is more dependent on US growth than any recovery in decades. That is because this recovery is extraordinarily dependent on exports. While Japan is steadily shifting its exports from the US to Asia, Japan’s ability to export to Asia hinges on Asia’s own ability to export to the US."

and

"......since 2001, there has been a 77 per cent correlation between Japanese GDP growth and exports a quarter earlier...."

"Those who say Japan is “decoupling” from the US would reply that, since 2002, exports to Asia have soared 52 per cent, while exports to the US are flat. But this view overlooks the triangular trade. Much of Japan’s exports to Asia and China consist of parts, supplies and equipment used for Asia’s own exports to the US. Japan is able to export so much to Asia only because Asia exports so much to the US. If Japan’s exports to Asia and China, which buy 40 per cent of Japan’s exports, were mainly for the domestic market, they would correlate with the ups and downs of these nations’ GDP. Instead, they correlate much better with Asian/Chinese exports to the US. If a US downturn caused the US to cut imports from Asia, Japan’s own export drive would stop in its tracks."

"Far from becoming “decoupled”, Japan’s economy has become even more dependent on US growth during this decade. America’s high-technology downturn in 2000 sent Japan and its Asian markets into a tailspin and then the US recovery served as the locomotive for recovery. In 2000-2007, the correlation between GDP growth in the US and Japan was 74 per cent. No other comparable period going back to at least 1980 even comes close."

Some idea of the intimate relation which operates between US growth and Japan growth can be observed in the chart below:

Apart from something that happened in Japan during 2004, and the last quarter of 2006 (which is of course exactly when the "decoupling" argument got going, more of this in other posts, there is something decidedly strange about Q4 2006 in more places than Japan) the fit ain't too bad, as they say.

Also, if we look at a chart comparing Japanese GDP growth and exports we can see that there is a strong general relation.

Now all of the above argument which Richard Katz advances I largely agree with - although I think possibly the share of Japanese exports to the eurozone might bear examination, since with the very low value of the yen, exports to Europe have also been on the rise. But this, in part, is beside the point, because of course - via German export dependency - the eurozone is itself partly dependent on US consumption growth (although this is to some extent masked by the current strong East European upswing, on which Germany is also very dependent).

The point is in part all this exporting has been possible due to the very low value of the yen. And why has the yen been so low? Well in large part this is a story of the very low interest rates offered by the Bank of Japan, and the consequent movements of funds out of Japan in search of yield (and in particular recently of retail investor funds, see Stephen Jen in this very interesting piece on the MS GEF last week).

And why has the Bank of Japan been unable to raise interest rates, well largely due to persistent deflation and very weak internal consumption growth, that's why.

Which brings us to why internal consumption is so weak, and to why Japan suffers from such persistent deflation. This is where I really part company from Richard Katz. For Richard the weak consumption is the result of a deliberate policy which has been pursued in Japan:

"Behind this inordinate export reliance is a recovery strategy that suppressed wages and consumer spending. Falling real wages raised corporate profits and helped finance the resolution of non-performing loans."

Now I'm not saying that intentional policy has played no part in this situation, but I seriously question whether it holds the biggest part of the explanation. Normal economic theory offers us two straightforward explanations as to why consumtion might weaken as populations age, and Japan's population (along with that of Germany and Italy) has aged very rapidly over the last couple of decades.

In the first place the standard life cycle saving and consumption theory - for which Franco Modigliani got a nobel prize - indicates that, since populations age just as individuals do, we ought to expect to observe patterns in the levels of savings and consumption as this ageing takes place, with the general feature that credit-driven consumption booms become less pronounced (since there are proportionately less young people to do the borrowing). This is in effect what we observe in all the three above named countries, none of which are likely to have a very strong "sub-prime" default issue on their domestic books, for the simple reason that despite the fact that their populations had access to the same low interest finance as everyone else, they simply did not have housing booms which were in any way comparable with those which occured in the US, Ireland, Spain, the UK or Australia.

In the second place there is productivity theory. This suggests that there is an age related pattern in our productivity profiles, with our level of productivity being comparatively low when we are young, rising to a peak in mid-life and then tapering off slowly as we get older. This produces what could be termed the "prime age worker" effect. This effect means that those societies who have the highest shares of workers in the 35 to 55 age group should be the most productive (in terms of their capacity to generate value added).

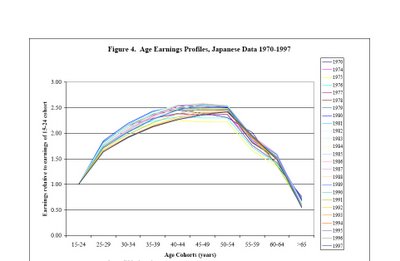

The prime age wage/productivity effect is illustrated in the chart below which shows how the age related earnings structure has moved in Japan over the years between 1970 and 1997.

Perhaps the most striking feature of this chart - apart, that is, from the fact that wages generally peak somewhere in the 50-54 range (assuming this wage profile to be some sort of reasonably proxy for what actually happens to productivity) - is the fact there has been little noticeable drift to the right and indeed that the curve has hardly shifted at all between the 1970s and the 1990s. This tends to suggest that while we are all living rather longer (as evidenced by our rising life expectancy) we are not necessarily leading "more productive" lives in the economic sense, or at least not to the same degree as our lives - including our working lives are getting longer.

These curves are of course interesting, since they give some economic explanation for why those societies with very high proportions of the labour force in the 15 to 30 age groups (the very high fertility societies) tend to have a comparatively lower standard of living than those with a high proportion in the 35 to 55 age groups. Equally it is not surprising to find that in a society like Japan, where there are a growing proportion of workers in the 55 to 75 age range (some outline of the employment dynamics of the Japanese labour market and their impact on wages can be found in this post), aggregate average wage levels are trending down in comparison to what they were earlier, rather like the wages commanded by a veteran football team would not be the same as those of a team when their players were at their prime.

These curves also give us something to think about in relation to one of the popular solutions advanced (see OECD, World Bank etc) for maintaining living standards in an ageing society - increasing female participation rates. This is of course entirely feasible as an objective, but it should be remembered that, in the Japanese case, the majority of the available female labour is in the comparatively higher age groups, and have limited education and work experience. So the per capita value of this labour, even if it were put to work, would be more likely to lower rather than raise the average wage level, even though it might raise the overall income generating capacity of Japan Inc as a totality, and might generate extra income for the government with which to pay for the growing demand on welfare services.

So the bottom line is that while it is clear that increasing participation can to some extent offset the decline in collective earning capacity, this process has limits and limitations. In particular these limitations mean that Japan is likely to be an export driven economy for many a year to come.

Which brings me neatly to the latest version of the "Concerned About Life" survey which is conducted annually by the Japan Cabinet Office and which was published last week in its 2007 version (Japanese only).

A record 69.5 percent of people surveyed (across the whole of Japan) were concerned or anxious about life, and this reading is up 1.9 percentage points from the previous survey last year. Among those who expressing concern, 53.7 percent felt anxious about life after retirement and 48.3 percent felt anxious about their health while 72.4 percent of total respondents called for the government to reform the social security system, particularly in the medical and pension fields.

When asked what they wanted from the government, 72.4 percent called for social security reform, 55.8 percent called on the government to take measures to deal with the aging of society and 49.6 percent urged the government to take measures to revive the economy.

Now I think it is reasonable to assume that a significant proportion of those people who want health and social security reform from the government don't want less health care and lower pensions, but this is precisely all any Japanese government can offer them give the export dependent growth and given the large government debt (as a % of GDP) that has already been accumulated.

So when 55.8 percent call on the government to "take measures to deal with the aging of society", the only measures that I know of which can help slow down the ageing process are accelerating immigration and raising fertility, but both of these issues needed to be addressed 20 years ago, and reacting now is going to be very hard work indeed. That is Japan's tragedy.